Understanding the Term “Account”

The term “account” can have different meanings depending on the context. In general, it refers to a record, profile, or arrangement used to track, manage, or represent something.

Financial Account

A financial account is an arrangement with a bank, credit union, or other financial institution where money is deposited, withdrawn, or managed.

Example: “I opened a savings account at the bank.”

User or Online Account

A user account is a registered profile on a website, app, or service. It allows you to access personalized features and content.

Example: “You need to create an account to use the app.”

Record or Statement

An account can also refer to a detailed record of transactions, events, or activities.

Example: “The accountant prepared an account of the company’s expenses.”

Explanation or Report

Finally, an account can describe events, experiences, or reasons in narrative form.

Example: “She gave an account of what happened at the meeting.”

Summary: An account is essentially a record, profile, or arrangement used to track, manage, or explain something.

The term “account” can have several meanings depending on context. Generally, it refers to a record, profile, or arrangement used to track, manage, or represent something.

Explanation or Report

Finally, an account can describe events, experiences, or reasons in narrative form.

Example: “She gave an account of what happened at the meeting.”

Summary: An account is a record, profile, or arrangement used to track, manage, or explain something.

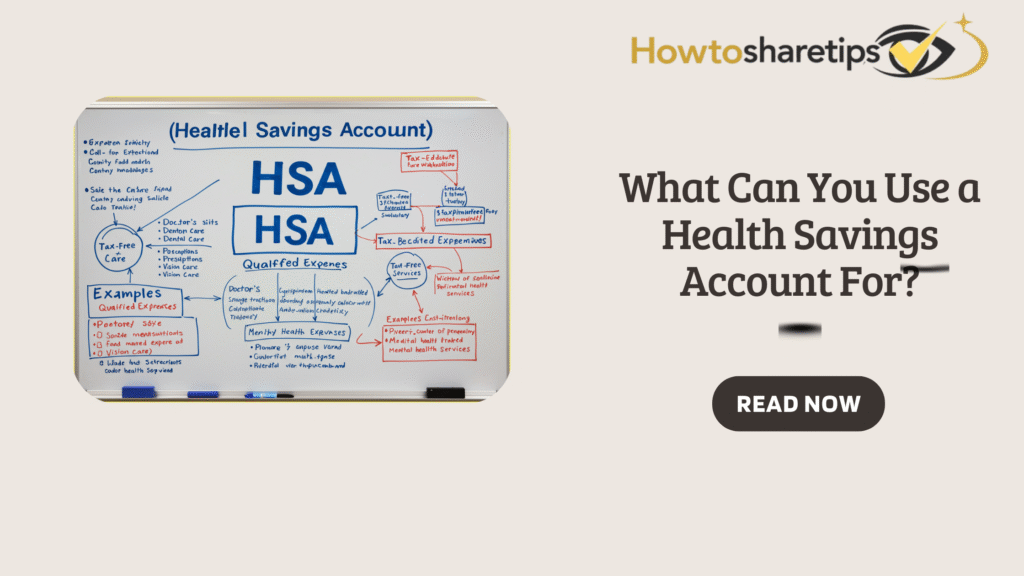

What Is a Health Savings Account (HSA)?

Managing healthcare expenses can feel overwhelming. A Health Savings Account (HSA) offers tax advantages while helping individuals and families pay for medical costs.

A Health Savings Account is a tax-advantaged savings account for individuals enrolled in a High-Deductible Health Plan (HDHP).

With an HSA, you can:

-

Contribute pre-tax dollars.

-

Grow your balance tax-free.

-

Withdraw funds for qualified medical expenses without paying taxes.

Unlike a Flexible Spending Account (FSA), your HSA balance rolls over each year. It is also portable, meaning you keep the funds even if you change jobs or health plans.

Contribution Limits (2025):

-

$4,300 for individuals

-

$8,550 for families

-

$1,000 catch-up contribution for people over 55

Eligible Medical Expenses Covered by an HSA

The IRS defines qualified medical expenses as costs for diagnosis, treatment, or prevention of disease.

1. Doctor Visits and Medical Services

HSA funds can cover:

-

Primary care visits and specialist consultations

-

Preventive care like physicals and vaccines

-

Mental health services, including therapy and counseling

-

Hospital stays, surgeries, and urgent care visits

2. Prescription Medications and Over-the-Counter Items

HSA funds can pay for:

-

Prescription drugs

-

Over-the-counter medications like ibuprofen or allergy relief

-

First-aid supplies, such as bandages or antiseptic creams

-

Menstrual care products

3. Dental and Vision Care

Funds can cover:

-

Routine dental cleanings and fillings

-

Orthodontics like braces

-

Eye exams, glasses, contact lenses, and LASIK surgery

4. Medical Equipment and Supplies

Qualified items include:

-

Blood pressure monitors

-

CPAP machines for sleep apnea

-

Hearing aids and batteries

-

Crutches, wheelchairs, and mobility aids

5. Other Qualified Expenses

HSAs can also pay for:

-

Acupuncture and chiropractic care

-

Fertility treatments such as IVF

-

Smoking cessation programs

-

Doctor-prescribed weight-loss programs

What You Cannot Use an HSA For

Not all health-related expenses qualify. Using HSA funds for non-medical purchases before age 65 results in taxes plus a 20% penalty.

Non-eligible expenses include:

-

Cosmetic surgery or Botox

-

Vitamins and supplements (unless prescribed)

-

Toothpaste, shampoo, and personal care items

-

Health insurance premiums, except COBRA or Medicare after age 65

Smart Ways to Maximize Your HSA

An HSA can do more than cover medical bills. You can use it to grow long-term wealth.

-

Save for the future – Unlike FSAs, HSA funds never expire, making them ideal for retirement medical costs.

-

Invest your balance – Many providers let you invest in mutual funds or ETFs to grow your account tax-free.

-

Pay out of pocket and reimburse later – Keep receipts for medical expenses and let your HSA balance grow. You can reimburse yourself later.

Why You Should Consider an HSA

HSAs are a powerful tool for managing healthcare costs and planning for retirement.

Benefits:

-

Triple tax advantage – Contributions are tax-deductible, growth is tax-free, and withdrawals for qualified expenses are tax-free.

-

Flexibility – Spend, save, or invest your funds.

-

Portability – Your account stays with you regardless of job changes.

For anyone with a high-deductible health plan, opening an HSA can reduce healthcare costs and provide a long-term financial safety net.

Frequently Asked Questions About HSAs

1. What is a Health Savings Account (HSA)?

A tax-advantaged account for medical expenses. Contributions are tax-deductible, grow tax-free, and withdrawals for qualified expenses are tax-free.

2. Who is eligible to open an HSA?

You must be enrolled in a High-Deductible Health Plan, not claimed as a dependent, and not enrolled in Medicare.

3. Can I use my HSA for regular checkups?

Yes, routine medical visits, annual physicals, and preventive screenings qualify.

4. Are prescription medications covered?

Yes, most prescribed drugs and insulin are covered.

5. Can I use my HSA for dental or vision care?

Yes, including exams, cleanings, glasses, contact lenses, and some dental procedures.

6. Are over-the-counter medications eligible?

Yes, if prescribed by a doctor. Some OTC medications are now eligible without a prescription.

7. Can I use my HSA for health insurance premiums?

Generally no, except for COBRA, long-term care, unemployment, or Medicare premiums if over 65.

8. Can I use my HSA for family members’ medical expenses?

Yes, for yourself, spouse, and dependents claimed on your taxes.

9. What happens if I use HSA money for non-qualified expenses?

Before age 65, you pay income tax plus a 20% penalty. After 65, non-qualified withdrawals are taxed but not penalized.

Conclusion

An account is a versatile concept that can refer to a financial record, an online profile, a detailed statement, or a narrative explanation. Understanding the type of account you are dealing with helps you manage your finances, track information, or communicate events accurately.

A Health Savings Account (HSA) is a powerful financial tool for anyone with a high-deductible health plan. It offers tax advantages, helps cover medical expenses, and provides opportunities to save and invest for the future. By using your HSA wisely, you can reduce healthcare costs, plan for retirement, and gain financial flexibility.

Overall, whether managing money, medical expenses, or personal records, understanding how accounts work empowers you to make informed decisions and take control of your financial and personal well-being.