What is OPay? Nigeria’s Leading Digital Payment Platform

OPay serves as a modern digital payment platform that centralizes financial services and daily transactions on your smartphone. It enables users to perform multiple financial activities from a single app, eliminating the need to manage several applications. With OPay, you can pay bills, order food, book rides, send and receive money, and even invest or save. The platform combines a digital wallet, merchant payment system, and on-demand services, consolidating all financial transactions into one interface for efficiency and convenience.

For individuals and small business owners, OPay simplifies daily transactions. Users transfer money, make QR payments, and perform cash-in or cash-out operations, saving time and focusing on more important personal or business activities. The app also stores all transactions in one place, making it easy to track spending, manage receipts, and plan budgets effectively. These features make OPay an essential tool for financial management.

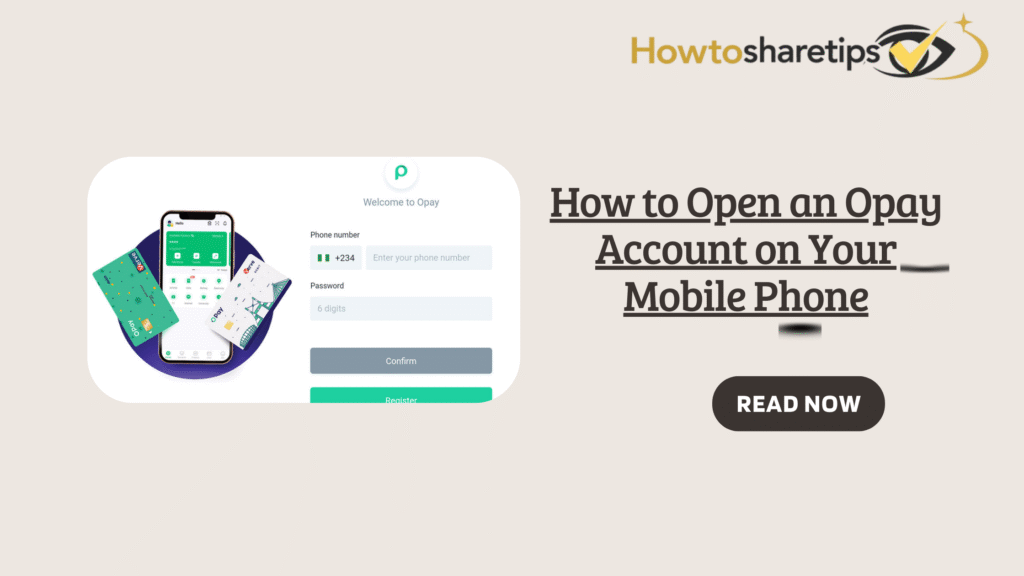

How to Open and Fund Your OPay Account

Opening an OPay account gives you complete control over your finances from your smartphone. The platform works on Android and iOS devices, so you can download the official OPay app from the Google Play Store or Apple App Store. The app provides a guided, user-friendly experience, letting you register and access multiple financial services without juggling several apps.

Register Your OPay Account

After installing the app, tap Create Account. Enter your phone number and verify it via SMS. Then, set a secure six-digit PIN to protect your account. Provide personal information including full name, email address, date of birth, gender, and state of residence. Upload a clear photograph for identity verification. Completing registration activates your account and allows you to immediately send money, pay bills, book rides, and order food.

Verify Your Account

Verification raises your transaction limits and strengthens account security. To verify, navigate to Me > KYC & Security > Verify Identity, choose your ID type, and upload photos of your identification along with a selfie. Once approved, you can fund your OPay wallet using bank transfers, debit or credit cards, or cash deposits at OPay agents. Fully funded and verified accounts provide full access to all OPay services while maintaining top-level security.

Using OPay Securely

Protecting your account ensures safe transactions. Start by creating a strong and unique PIN or password, and enable two-factor authentication (2FA). Use biometric login such as fingerprint or facial recognition whenever possible.

Monitor all transactions by turning on notifications, reviewing transaction history regularly, and setting spending limits. Avoid public Wi-Fi for financial activities, keep your app and smartphone updated, and verify recipients before sending money. Never share your PIN, password, or OTP. If you use an OPay card, activate alerts, use virtual cards for online payments, and immediately freeze or block lost cards. Following these practices ensures a secure digital payment experience.

Benefits of Using OPay

OPay provides unmatched convenience by allowing users to pay bills, transfer funds, order food, and book rides all from one app. Services remain accessible 24/7, ensuring you can manage your finances anytime.

The platform emphasizes security with encryption, PINs, and multi-factor authentication. Transaction alerts help detect unauthorized activity, and OPay’s operations comply with Central Bank of Nigeria regulations, offering reliable and safe services.

OPay also goes beyond payments. You can invest, monitor spending, top up airtime, and accept QR payments, reducing cash handling for merchants. By combining multiple financial services into one platform, OPay simplifies financial management for both individuals and businesses.

Making Payments with OPay

OPay supports a wide range of payments. Users can pay utility bills, including electricity, water, and gas, as well as telecom services like airtime and data subscriptions. You can also settle entertainment bills for cable TV and manage education or insurance payments, including school fees and insurance premiums, directly through the app.

Merchants benefit from OPay’s payment features by accepting QR code payments or phone number transfers, reducing the need for cash handling and making checkout faster. Users can transfer money instantly to other OPay users or directly to bank accounts, providing flexibility for personal or business transactions.

OPay Additional Features

OPay extends its services beyond payments to offer lifestyle and investment tools. ORide lets you book motorcycles or cars for on-demand transport, while OFood helps you order meals and track delivery. OWealth provides basic investment and savings opportunities, enabling users to grow their funds. OBet allows participation in sports and gaming bets safely, and OTravel lets you book flights, hotels, and event tickets directly from the app. These features establish OPay as a comprehensive digital lifestyle platform.

Requesting and Using Your OPay Card

OPay provides physical and virtual cards to enhance payment flexibility. Once your account is verified, open the Card section in the app to request a card. Confirm your shipping address, select the card type, and review applicable fees. Fund your card through your wallet, bank transfer, or cash deposit.

After funding, you can use your OPay card for ATM withdrawals, in-store purchases, online shopping, and international transactions. The app allows you to monitor transactions and set spending limits, giving you complete control over your finances.

Is OPay Safe? Security and Regulatory Compliance

OPay prioritizes user safety through regulatory compliance, advanced security measures, and user education. The platform follows electronic payment guidelines under the Central Bank of Nigeria and complies with PCI DSS standards, which protect all transactions and user data.

Advanced security features include NightGuard, which secures accounts using facial recognition during specific hours, and Large Transaction Shield, which enforces personalized limits requiring facial recognition for large transfers. Users can instantly lock accounts or cards via USSD if their devices are lost. OPay also uses fraud detection systems to monitor suspicious activity and send immediate alerts.

OPay educates users on phishing risks, OTP protection, and safe transactions. It advises against sharing sensitive information and encourages caution with unsolicited messages, creating a secure and informed user experience.

User Experience and Safety Tips

OPay provides fast and convenient transactions, though occasional delays or slow support may occur. Users should always verify recipient details before sending money. Enabling all security features, protecting devices, and monitoring transactions regularly maximizes safety and ensures a smooth experience.

Frequently Asked Questions About OPay

OPay functions as a secure, fast, and convenient digital payment platform that combines payments, transfers, bill payments, ride booking, food delivery, and investment options in a single app. It supports Android and iOS devices and requires an internet connection for downloading, registering, and verifying accounts. Users must provide personal information including full name, phone number, email, date of birth, gender, state of residence, valid ID, and a selfie for verification. Registration requires a Nigerian phone number, and users must be at least 18 years old. Opening an account is free, though some transactions incur fees. Account activation occurs immediately after registration, while full verification may take several hours or days. Each phone number allows only one account to maintain security.

Conclusion: Why OPay Stands Out as a Digital Payment Platform

OPay offers a comprehensive, convenient, and secure solution for managing personal and business finances. By combining payments, transfers, bill payments, ride-hailing, food delivery, investment, and travel services into one platform, it removes the need for multiple apps, saving time and improving efficiency. Advanced security features, regulatory compliance, and user education ensure that all transactions remain safe and reliable. Whether for daily personal use or merchant transactions, OPay provides a versatile digital payment ecosystem that empowers users with convenience, control, and peace of mind