What Is an FCMB Bank Account?

An FCMB Bank account is a financial product offered by First City Monument Bank (FCMB), one of Nigeria’s leading commercial banks. It helps individuals and businesses manage their finances effectively. By opening an FCMB account, you gain access to essential banking services, including depositing and withdrawing funds, transferring money, paying bills, and checking balances. FCMB offers multiple account types, personal savings, current, domiciliary, fixed deposit, salary, and corporate accounts—ensuring that every customer, whether an individual or business, can find a solution that fits their financial goals.

Features of an FCMB Bank Account

FCMB accounts provide convenience and accessibility. Customers can link their accounts to debit or ATM cards for withdrawals and purchases locally and internationally. The bank offers digital platforms like online and mobile banking. These platforms allow users to perform transactions, pay bills, and monitor activity anywhere. FCMB also protects accounts using encryption, two-factor authentication, and real-time transaction alerts, keeping funds and personal information secure.

What Is an FCMB Bank Account Used For?

FCMB accounts serve multiple purposes. Individuals can deposit and save money securely while earning interest on eligible savings accounts. This helps customers grow their funds over time. Users can also organize finances, separate spending from savings, and plan for future financial goals.

Beyond saving, FCMB accounts enable seamless payments and transactions. Account holders can pay utility bills, transfer money within FCMB or to other banks, and make purchases with debit or ATM cards. The bank’s mobile and internet platforms allow customers to monitor activity, schedule automated payments, and complete transactions remotely.

FCMB accounts also provide access to financial products. Individuals may qualify for personal or business loans and investment opportunities. Corporate accounts support payroll management, vendor payments, and other business operations. Combining secure storage, easy transactions, and access to credit, FCMB accounts offer a complete banking experience.

Why Choose FCMB Bank?

FCMB is one of Nigeria’s leading financial institutions. With decades of experience, the bank is known for reliability, innovative solutions, and customer-focused services. Customers can access savings, current, and youth accounts tailored to their financial goals. A wide network of branches and ATMs across Nigeria ensures convenient access to funds and services.

Digital Banking Convenience

FCMB provides robust digital banking via its mobile app and internet platform. Customers can transfer funds, pay bills, and even open accounts online. Cardless withdrawals, real-time account management, and investment options allow users to manage finances securely from anywhere.

Support for Businesses and Entrepreneurs

FCMB supports businesses, entrepreneurs, and women through programs like SME initiatives and SheVentures. The bank offers loans, mentoring, and training opportunities. Premium banking customers enjoy perks such as airport lounge access, travel insurance, and lifestyle benefits. FCMB adds value beyond standard banking services.

Key Benefits of FCMB Bank

FCMB accounts offer multiple benefits. Online and mobile platforms allow transactions anytime, anywhere. Real-time updates and alerts give customers full control over their finances without visiting a branch.

The bank provides a variety of account types: savings, current, domiciliary, salary, fixed deposit, and corporate accounts. These accounts help customers manage daily expenses, save for the future, conduct international transactions, or run businesses efficiently.

FCMB also offers credit facilities. Customers can access personal loans, business loans, and overdrafts. Advanced security protects funds and data. Rewards and incentives, including discounts and special offers, add extra value to everyday banking.

Types of FCMB Bank Accounts

Personal Accounts

Savings Accounts: Save money securely while earning interest.

Current Accounts: Ideal for frequent transactions with unlimited deposits and withdrawals.

Youth and Student Accounts: Encourage saving habits with low minimum balances.

Business and Corporate Accounts

Corporate Accounts: Support large organizations with payroll and treasury services.

SME Accounts: Offer loans, trade financing, and advisory services for small and medium businesses.

Specialized and Premium Accounts

Premium Banking Accounts: Provide airport lounge access, travel insurance, and priority banking.

Diaspora Accounts: Facilitate international transactions, foreign currency access, and remittances for Nigerians abroad.

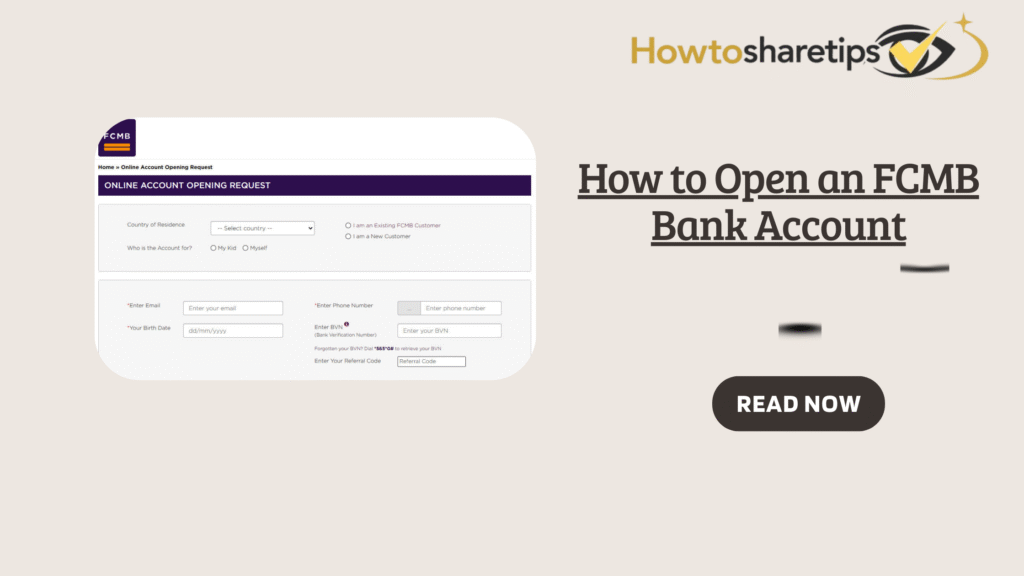

How to Open an FCMB Bank Account

Choose the Right Account: Compare deposit requirements, transaction frequency, interest rates, and benefits to select the best option.

Gather Required Documents:

Individuals: valid ID, proof of address, passport photograph, proof of income, reference letter (if needed).

Businesses: registration documents, tax ID, board resolution authorizing account signatories.

Apply and Fund Your Account:

In-branch: Submit documents, complete forms, and make a minimum deposit.

Online: Apply via the FCMB website or app, upload documents, and fund electronically.

Complete Registration: Activate your account using the SMS/email confirmation code. Collect your debit card, cheque book, and set up digital banking credentials.

Accessing and Managing Your FCMB Account

FCMB combines digital and traditional banking for convenience.

Digital Platforms: The mobile app and online banking allow transfers, bill payments, airtime recharge, and automated payments. Strong authentication protects accounts and ensures secure, real-time updates.

ATMs and Branches: FCMB ATMs support withdrawals, deposits, balance checks, and cardless transactions. Branches provide in-person support for inquiries, loans, and corporate services. Using both channels gives customers flexibility in managing money safely and efficiently.

Frequently Asked Questions (FAQ)

What account types can I open? Savings, current, youth, and corporate accounts.

What documents are required? Valid ID, proof of address, passport photograph, and completed form; businesses need registration documents.

Can I open an account online? Yes, via the FCMB website or mobile app.

Minimum deposit? Varies by account type.

How long to open an account? Same-day for branch applications; online may take a few hours to a couple of days.

Do I get a debit/ATM card? Yes, for most account types.

Can non-Nigerians open an account? Yes, with a valid passport and residence permit.

Monthly maintenance fee? Depends on account type and balance.

Can I open a joint account? Yes, requirements may differ.

How do I fund my account? Cash deposits, online transfers, or accepted third-party services.

Conclusion

Opening an FCMB Bank account provides a gateway to comprehensive banking services tailored to meet the needs of individuals, businesses, and corporations. With multiple account types available, including savings, current, youth, corporate, and premium accounts, customers can choose the option that aligns with their financial goals. The bank’s wide network of branches and ATMs across Nigeria ensures easy access to funds, while its robust digital banking platforms allow customers to manage their finances efficiently from anywhere, providing both convenience and security.

Beyond basic banking, FCMB offers a range of value-added services that enhance the financial experience. Account holders can access personal and business loans, investment opportunities, and financial advisory services that support wealth growth and financial planning. Small and medium-sized enterprises benefit from tailored SME support programs, including advisory services, intervention funds, and technical assistance, enabling businesses to grow sustainably. These services make FCMB not just a bank, but a strategic financial partner for both individuals and organizations.

Moreover, FCMB’s premium banking services and lifestyle perks provide additional advantages for customers seeking enhanced banking experiences. These include travel and lifestyle benefits, priority banking services, and exclusive financial solutions designed to cater to high-net-worth individuals and entrepreneurs. Overall, opening an FCMB account ensures reliable, secure, and versatile banking, empowering customers to manage their money effectively, access financial growth opportunities, and enjoy a seamless banking experience that adapts to their evolving needs.