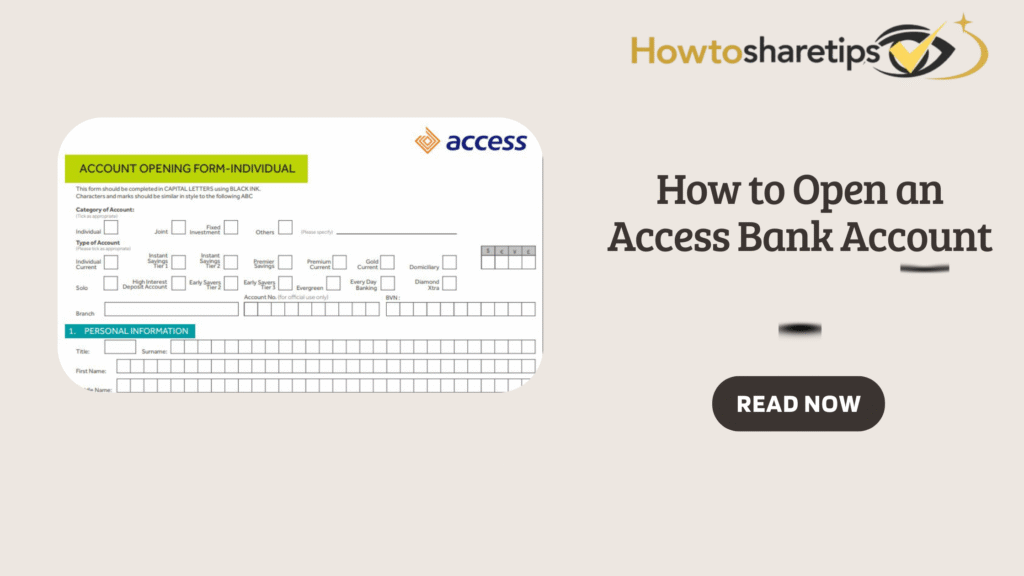

How to Open an Access Bank Account

Opening an Access Bank account is straightforward and gives individuals and businesses convenient access to banking services. Access Bank offers several account types, including savings, current, and corporate accounts. Each account serves different financial needs. To start, visit any Access Bank branch or begin online via the bank’s official website. You typically need valid identification, proof of address, a recent passport photograph, and an initial deposit. The deposit amount depends on the account type. Meeting these requirements ensures a smooth account opening process.

Opening an Account Digitally

Access Bank has simplified account opening through digital solutions. Online applicants can fill out the form, upload documents, and submit them electronically. This reduces the need for lengthy branch visits. Customers can complete most of the process from home or office. Access Bank provides clear instructions and support at every step. Once verified, applicants receive account details and immediate access to banking services.

Benefits of Access Bank Accounts

Access Bank accounts offer several advantages. Customers receive debit and ATM cards, mobile and internet banking access, and transaction alerts. These tools make fund transfers, bill payments, and account monitoring easy. With an Access Bank account, you secure your money and gain tools to manage finances efficiently. Whether saving, handling daily transactions, or running a business, these accounts provide a reliable foundation for financial goals.

Step-by-Step Guide to Opening an Access Bank Account

Opening an account can feel overwhelming, but following these steps makes it simple:

Step 1: Choose Your Account Type

Review the options and select one that fits your personal or business needs.

Step 2: Prepare Documents

Gather your passport photo, BVN, valid ID, and proof of address.

Step 3: Apply Online or In-Branch

Visit a branch or apply via the Access Bank website or mobile app.

Step 4: Complete the Form

Provide accurate information to avoid delays.

Step 5: Activate Your Account

Fund the account with the initial deposit (if required) to start using it.

Opening an Account Using USSD

You can open an Access Bank account via your phone using USSD:

-

Dial 9010# on your registered SIM.

-

Follow the prompts on-screen.

-

Provide your BVN or personal details.

-

Receive your account number via SMS.

No internet connection is required for this method.

Opening an Account Online

You can also open an account digitally:

-

Download the Access Bank app or visit the website.

-

Provide a valid email, phone number, and residential address.

-

Enter next of kin details.

-

Submit documents electronically.

-

Receive account details once verified.

Documents Required

Prepare these documents to avoid delays:

-

Completed account opening form

-

One passport photograph

-

Valid ID (National ID, International Passport, Driver’s License, or Voter’s Card)

-

Bank Verification Number (BVN)

-

Proof of residence (utility bill or similar)

Requirements may vary depending on the account type.

Types of Access Bank Accounts

Access Bank provides a wide variety of account types to meet the diverse needs of individuals, businesses, and corporate clients. Each account is designed with specific features and benefits that cater to different financial goals. For personal banking, options like the Everyday Banking Account and Evergreen Account provide simple, flexible solutions for daily transactions and savings. The Black Card Account and Exclusive Private Banker Account target customers seeking premium banking services, offering higher limits, exclusive privileges, and personalized financial support.

For businesses and organizations, Access Bank offers accounts such as the Business Advantage Account, Corporate Account, and DBA Account. These accounts facilitate seamless business operations, enabling efficient payments, payroll management, and access to loans or overdraft facilities. The Money Transfer Account allows businesses and individuals to handle local and international transfers with ease, while the Domiciliary Account supports foreign currency transactions, making it ideal for those dealing with global trade or overseas remittances.

Specialized accounts like the Home Invest Account cater to long-term financial planning and investment goals. The Solo Account, on the other hand, is designed for individual customers seeking straightforward banking solutions without complex requirements. By offering this extensive range of accounts, Access Bank ensures that every customer can find a solution tailored to their financial needs. Choosing the right account type helps optimize access to banking tools, improve financial management, and achieve personal or business objectives efficiently.

Access Bank offers multiple account types:

-

Black Card Account

-

Business Advantage Account

-

Corporate Account

-

DBA Account

-

Domiciliary Account (foreign currency)

-

Evergreen Account

-

Everyday Banking Account

-

Exclusive Private Banker Account

-

Home Invest Account

-

Money Transfer Account

-

Solo Account

Each account has unique features. Choose the one that fits your financial goals.

Benefits of Opening an Access Bank Account

Key advantages include:

-

No opening balance for some accounts

-

No minimum balance requirements

-

No account maintenance fees

-

Access to chequebooks and debit cards

-

Naira credit cards

-

Online, mobile, and telephone banking

-

Direct debit authorization

-

Third-party transactions allowed

-

Loans, mortgages, and school fee advances

FAQs

1. What is the USSD code for opening an Access Bank account?

The official code is 9010#.

2. Can I open an account without visiting a branch?

Yes, you can apply online via the website or mobile app.

3. What do I need to open an account online?

You need a valid email, phone number, BVN, proof of address, and next of kin information.

4. Can I open a domiciliary account online?

No, you must visit a branch for domiciliary accounts due to extra documentation requirements.

5. Can non-Nigerians open an account?

Yes, with valid identification, proof of residence, and necessary documentation.

6. Are there fees for opening an account?

Standard accounts usually have no fees. Specialized accounts may have minimum balance requirements.

7. Can I open a joint account?

Yes, joint accounts are allowed. All holders must provide valid identification.

8. How do I activate my account?

Activate by logging into online or mobile banking or visiting a branch. Set up ATM and internet banking credentials.

9. What documents are accepted as proof of address?

Utility bills, bank statements, tenancy agreements, or government-issued correspondence dated within three months.

Conclusion

Opening an Access Bank account is now easier than ever, thanks to multiple convenient channels tailored to suit different customer needs. Whether you prefer visiting a branch, completing the process online, or using the USSD code on your mobile phone, the steps are straightforward and designed to save time. Each option provides clear instructions and guidance, ensuring that first-time account holders can open their accounts without stress. By providing these flexible solutions, Access Bank demonstrates its commitment to making banking accessible to every individual and business across Nigeria.

Access Bank also offers a wide range of account types and financial tools that cater to personal, business, and corporate banking needs. From debit and credit cards to loans, overdrafts, and online banking, customers have access to resources that simplify money management. Automated alerts, mobile banking, and real-time transaction monitoring further enhance the banking experience. These features help customers control their finances efficiently, reduce risks, and plan effectively for both short-term and long-term financial goals.

Choosing Access Bank ensures not only convenience but also security and reliability. With a strong branch and ATM network, comprehensive digital banking platforms, and responsive customer support, customers can access their funds anytime and anywhere. The bank’s focus on innovation and customer service makes it a trusted partner for personal savings, business operations, and investment planning. Ultimately, opening an Access Bank account equips you with the tools and support needed to manage your finances confidently and achieve your financial aspirations