What is Zenith Bank

Zenith Bank is one of Nigeria’s leading financial institutions. It is known for innovative banking solutions and excellent customer service. Established in May 1990, the bank has grown into a major player in both Nigerian and international banking. It provides personal banking, corporate banking, investment solutions, and treasury services. Zenith Bank serves individuals, small businesses, and large corporations. Over the years, it has demonstrated financial stability, operational excellence, and technological innovation, earning trust as a reliable banking partner.

Leveraging Technology for Better Banking

Zenith Bank uses advanced technology to improve customer experience and operational efficiency. Its mobile and online platforms allow customers to perform transactions, manage accounts, and access financial products safely. The bank also offers trade finance, asset management, and advisory services, making it a one-stop financial hub for businesses and investors. With a wide branch network in Nigeria and a strategic international presence, Zenith Bank combines accessibility with global expertise for seamless banking.

Corporate Social Responsibility

The bank actively supports education, health, and entrepreneurship programs. Its corporate social responsibility initiatives demonstrate a commitment to societal growth and sustainability. Zenith Bank also prioritizes ethical banking practices and regulatory compliance, earning numerous awards locally and internationally. By combining innovation, customer-focused services, and social responsibility, the bank promotes economic growth and positive social impact.

Zenith Bank Branch Network

Zenith Bank operates over 500 branches, serving millions of customers. It offers personal, business, and savings accounts to meet diverse needs.

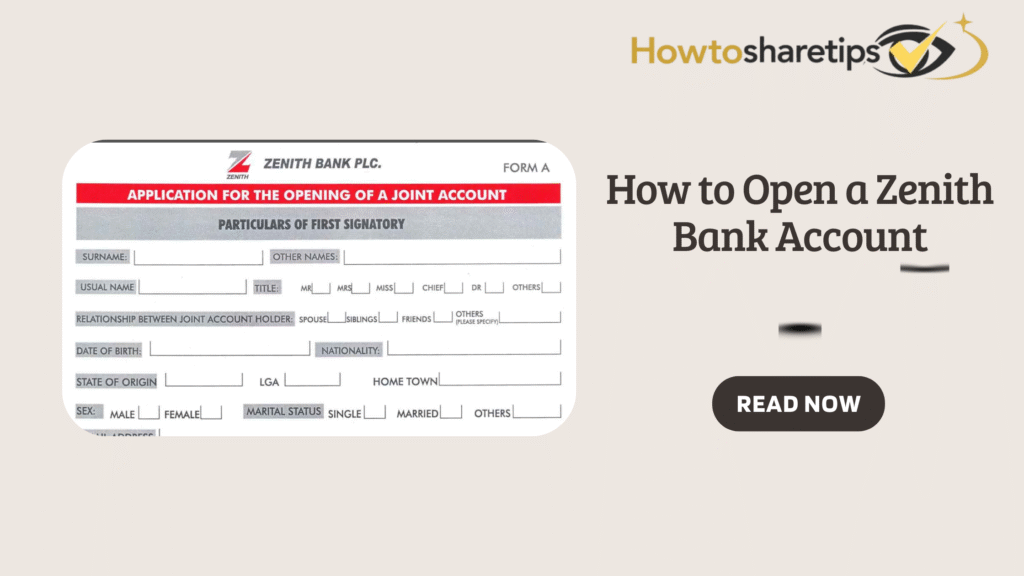

How to Open a Zenith Bank Account

Opening a Zenith Bank account is simple and can be done online, via mobile banking, or in-branch.

Step 1: Research and Choose the Right Account

Consider your financial goals, transaction needs, and how often you will access your funds. Zenith Bank’s account opening calculator can help you select the best account type.

Step 2: Gather Required Documents

You generally need:

-

Valid ID (National ID, Driver’s License, Passport, or Voter’s Card)

-

Recent passport photograph

-

Proof of address (utility bill, tenancy agreement, or bank statement)

-

Proof of income (pay slip, employment letter, or tax clearance)

-

Reference letter (optional)

Some accounts may require additional documents, such as a school ID or admission letter.

Step 3: Apply Online or In-Branch

Online:

-

Visit the Zenith Bank website and click “Open Account.”

-

Select the account type and complete the online form.

-

Upload required documents and fund your account.

-

Wait for a confirmation email with your account number.

In-Branch:

-

Locate the nearest Zenith Bank branch.

-

Complete the account opening form with a customer service representative.

-

Submit documents and fund the account.

-

Wait for verification.

Step 4: Complete Account Activation

Activate your account using the provided code. Collect your debit card, chequebook, and online banking credentials. Fund your account and perform your first transaction.

Step 5: Manage Your Account

You can manage your account through multiple channels:

-

Online Banking: Access accounts from your computer or smartphone

-

Mobile App: Transfer funds, pay bills, and check balances

-

ATM: Withdraw, deposit, and transfer money

-

POS: Make payments using your debit card

-

USSD: Dial *966# to perform transactions or check your balance

Types of Zenith Bank Accounts

Savings Account

-

Minimum opening balance: N1,000

-

Interest: 1.25% annually

-

Free withdrawals from Zenith ATMs

Current Account

-

Minimum opening balance: N5,000

-

Monthly maintenance fee: N1,000

-

Overdraft, free debit card, and chequebook

Fixed Deposit Account

-

Minimum deposit: N100,000

-

Terms: 30–365 days

-

Higher interest rates

Domiciliary Account

-

Minimum deposit: $100, £100, €100

-

Transact in foreign currencies at competitive rates

Salary Account

-

No minimum balance or maintenance fee

-

Receive salary, access loans up to 60% of monthly income

Corporate Account

-

Minimum deposit: N50,000

-

Services: trade finance, cash management, advisory

Benefits of Opening a Zenith Bank Account

Opening a Zenith Bank account provides several advantages:

-

Convenient online and mobile banking for transactions anywhere

-

Use of debit, credit, and prepaid cards at ATMs, POS terminals, and online

-

Easy access to loans and credit facilities including overdrafts with flexible terms

-

Rewards and discounts from Zenith Bank programs

-

Advanced security measures to protect funds and personal information

Frequently Asked Questions (FAQ)

1. What types of accounts can I open at Zenith Bank?

-

Aspire Accounts for students aged 16–25

-

Timeless Accounts for senior citizens

-

ZECA Accounts for children aged 0–15

-

Standard savings and current accounts

2. What are the requirements to open an account?

-

Completed account opening form

-

Valid ID (National ID, Passport, Driver’s License, or Voter’s Card)

-

Recent passport photograph

-

Bank Verification Number (BVN)

Additional documents may be required depending on the account type.

3. Can I open an account online?

Yes. You can start the process on Zenith Bank’s website or via mobile banking by dialing 9660#.

4. Is there a minimum balance?

Some accounts, like Aspire Accounts for students, do not require a minimum balance. Other accounts have an initial deposit requirement.

5. How long does it take to open an account?

Online and mobile applications take minutes. In-branch registration may take longer due to verification.

6. Can non-residents open an account?

Yes, with additional documents such as a valid residence permit.

7. Are there accounts specifically for children or students?

Yes. ZECA Accounts are for children 0–15, Aspire Accounts for students 16–25.

8. What if I encounter problems during account opening?

Contact Zenith Bank’s customer service via hotline, email, or visit a branch for assistance.

Conclusion

Opening a Zenith Bank account is fast, secure, and convenient. With a variety of accounts—including Aspire, Timeless, ZECA, and standard savings and current accounts—every customer can find an option tailored to their needs.

Zenith Bank provides multiple channels for account opening, emphasizing security, regulatory compliance, and customer support. Minimal documentation requirements allow customers to set up accounts quickly and access a wide range of financial services.

Whether your goal is saving, investing, or managing daily transactions, Zenith Bank offers a reliable foundation for financial growth. By focusing on innovation, customer satisfaction, and social responsibility, Zenith Bank maintains its leadership in Nigeria while making a positive societal impact.