Apple Pay is a digital payment and mobile wallet service developed by Apple Inc. It allows users to make secure payments in stores, online, and within apps using their Apple devices, such as iPhone, Apple Watch, iPad, or Mac.

Here’s how it works:

-

You link your credit or debit card to Apple Pay through the Wallet app.

-

When making a purchase in stores, you hold your device near a contactless payment terminal and authenticate with Face ID, Touch ID, or passcode.

-

For online or in-app purchases, you select Apple Pay at checkout and confirm using your device’s authentication method.

Key benefits of Apple Pay:

-

Convenience: No need to carry physical cards or cash.

-

Security: Uses tokenization and device-specific codes instead of transmitting your actual card number.

-

Privacy: Apple does not store transaction information that can be tied to you.

-

Speed: Transactions are faster than traditional card payments.

In short, Apple Pay is a secure and contactless way to pay using Apple devices, making purchases easier and safer.

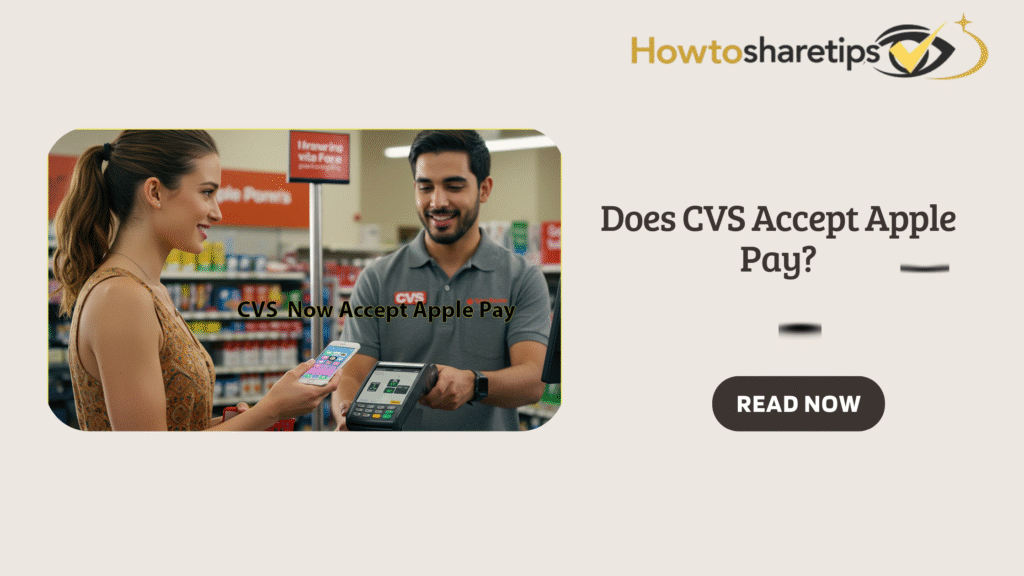

When I first heard about Apple Pay being accepted in stores, my biggest question was whether CVS, my go-to pharmacy for prescriptions and everyday essentials, supported it. As someone who loves quick and contactless checkouts, I decided to find out if CVS really accepts Apple Pay and how you can use it to make shopping smoother.

This guide will walk you through CVS’s Apple Pay policy, how it works in stores and online, its benefits, and what other payment options CVS customers can use.

Does CVS Accept Apple Pay?

Yes, CVS does accept Apple Pay in most locations across the United States. I’ve personally used it at multiple CVS stores, and it works flawlessly. Simply hold your iPhone or Apple Watch near the contactless reader and authenticate with Face ID, Touch ID, or your passcode.

That said, it’s best to confirm with your local CVS store because acceptance may vary in some locations, especially those inside larger retailers like Target, which may run on different payment systems.

Why CVS Adopted Apple Pay

CVS officially rolled out Apple Pay acceptance around 2018 after years of holding back due to competing mobile payment systems. The shift happened as customer demand for contactless, secure, and fast checkout grew.

Apple Pay uses tokenization, generating a unique code for each transaction instead of sharing your card number. This protects sensitive card data and makes transactions more secure. CVS’s adoption of Apple Pay also helped it keep pace with competitors like Walgreens, which had already embraced the payment method.

How to Use Apple Pay at CVS

Using Apple Pay at CVS is quick and simple:

-

Set Up Your Wallet App – Add a debit or credit card to your Apple Wallet. Most major banks, including Chase, Citi, Wells Fargo, and Bank of America, are supported.

-

At Checkout – Look for the contactless payment symbol on the CVS terminal.

-

On iPhone: Double-click the side button, authenticate, and hold near the reader.

-

On Apple Watch: Double-click the side button and place your watch near the reader.

-

-

Online or App Purchases – Some transactions on CVS.com and the CVS app also allow Apple Pay at checkout, especially for prescriptions and select items. Availability, however, can vary.

Benefits of Using Apple Pay at CVS

-

Faster Checkout: Tap and go in seconds, no swiping or signing required.

-

Security: Card details are never shared with CVS. Instead, Apple Pay uses encryption and authentication to keep transactions safe.

-

Contactless Convenience: Perfect for reducing contact with surfaces.

-

Rewards Integration: Earn CVS ExtraCare points the same way you would with a physical card.

-

Digital Tracking: Purchases are recorded in your Wallet app, making budgeting easier.

Other Payment Methods CVS Accepts

In addition to Apple Pay, CVS also accepts:

-

Cash, debit, and major credit cards (Visa, Mastercard, Discover, Amex)

-

Google Pay and Samsung Pay

-

PayPal and Venmo (online and app)

-

Contactless credit/debit cards with the NFC symbol

-

CVS ExtraCare-linked payments for seamless rewards

Tips for Smooth Apple Pay Checkout at CVS

-

Make sure your device is charged before shopping.

-

Have Apple Pay ready when you reach the cashier to avoid delays.

-

Keep a backup card or cash in case of rare technical issues.

-

Confirm acceptance at smaller or partnered CVS locations (like those inside Target).

FAQs About Apple Pay at CVS

Q: Does CVS accept Apple Pay for prescriptions?

Yes, Apple Pay works for prescription pickups at most CVS pharmacies.

Q: Do I earn CVS ExtraCare rewards with Apple Pay?

Yes. Just link your ExtraCare account or scan your card/app.

Q: Does CVS accept Apple Pay online?

Yes, but only for select purchases on CVS.com and the CVS app. Some services, like photo printing or deliveries, may require a card instead.

Q: Is Apple Pay safe to use at CVS?

Absolutely. With tokenization and Face ID/Touch ID authentication, it’s one of the most secure ways to pay.

Q: Can I return an item bought with Apple Pay at CVS?

Yes, returns are processed the same as with cards. Simply provide your receipt or let the cashier look up the transaction through your Apple Pay device.

So, does CVS take Apple Pay? Yes, CVS accepts Apple Pay in most stores, making checkout fast, secure, and contactless. You’ll still earn ExtraCare rewards, and you can use it both in-store and, in some cases, online.

If you want a hassle-free way to shop at CVS without fumbling for cash or cards, Apple Pay is one of the best options. Next time you head to CVS for prescriptions or essentials, give it a try, you might never go back to traditional checkout again.

Frequently Asked Questions (FAQ) About Credit Limits

1. What is a credit limit?

A credit limit is the maximum amount of money a lender allows you to borrow on a credit account, such as a credit card, line of credit, or overdraft.

2. How is a credit limit determined?

Lenders determine your limit based on your credit score, income, repayment history, existing debt, and overall financial profile.

3. Can my credit limit change over time?

Yes. Lenders can increase or decrease your limit depending on your financial behavior, timely payments, and creditworthiness.

4. What happens if I exceed my credit limit?

Exceeding your limit may result in over-limit fees, higher interest rates, or declined transactions. It can also negatively affect your credit score.

5. Does a higher credit limit improve my credit score?

A higher limit can improve your credit utilization ratio if you keep balances low, which may boost your credit score. Misusing it can harm your score.

6. How can I request a credit limit increase?

You can request an increase by contacting your lender, updating financial information, and demonstrating responsible credit usage.

7. Are there risks associated with a higher credit limit?

Yes. Higher limits may tempt overspending, increase debt, and result in higher fees or interest if not managed responsibly.

8. How can I stay within my credit limit?

Monitor your spending, track available credit, make timely payments, and avoid unnecessary purchases to stay within your limit.

9. What is the difference between fixed and variable credit limits?

A fixed limit stays the same unless the lender adjusts it, while a variable limit can increase or decrease based on your payment history and financial behavior.

10. How does credit utilization affect my credit score?

Credit utilization measures the percentage of your available credit you use. Keeping it below 30% generally helps maintain a strong credit score.

11. Can having multiple credit accounts affect my overall credit limit?

Yes. Each account has its own limit, but lenders also consider your total credit exposure when approving new credit or limit increases.

12. Will requesting a credit limit increase affect my credit score?

Some lenders perform a hard credit inquiry when reviewing a limit increase, which may temporarily lower your score. However, responsible management can improve it over time.