What is the Apple Card?

Apple Card is a revolutionary credit card created by Apple Inc., in collaboration with Goldman Sachs and Mastercard. Notably, it integrates seamlessly with Apple devices, allowing users to manage payments directly from the iPhone Wallet app. In addition, it simplifies financial management by letting users track spending, make payments, and view detailed transaction histories in real time. Furthermore, Apple emphasizes security and privacy by issuing unique card numbers for online purchases, requiring Face ID or Touch ID verification, and enforcing two-factor authentication to prevent fraud. Consequently, users can feel confident in using Apple Card for both digital and in-person transactions.

Unlike traditional credit cards, Apple Card provides Daily Cash rewards, which are credited instantly to users’ Apple Cash accounts. Whereas most rewards programs pay out monthly, Apple Card gives immediate access to earned rewards. Moreover, the card has no annual fees, no foreign transaction fees, and no late fees. Users can monitor spending trends and manage balances efficiently through the Wallet app. As a result, Apple positions this card as a digital-first solution that combines convenience, security, and transparency, making it especially appealing to iPhone users.

Key Benefits of Apple Card

Apple Card provides several unique advantages. First, its deep integration with the Apple ecosystem allows individuals to monitor credit activity entirely from their devices. Additionally, the Wallet app automatically categorizes transactions, delivers spending summaries, and sends real-time notifications for purchases and payments. Consequently, users can manage their finances without relying on third-party apps, which reduces financial stress. Moreover, interactive visuals and analytical tools in the Wallet app help users make informed financial decisions and maintain full control over their money.

Another major benefit is the Daily Cash rewards system. Purchases at Apple earn three percent cash back, Apple Pay transactions earn two percent, and purchases made with the Titanium card earn one percent. Importantly, Apple credits these rewards daily, giving users immediate access. Users can apply rewards to their Apple Card balance, spend them through Apple Pay, or transfer them to a bank account. Therefore, the system is both simple and transparent, allowing users to maximize financial benefits effortlessly. As a result, users enjoy convenience and financial control simultaneously.

Security is another standout feature. Apple protects digital transactions with unique card numbers and verification through Face ID or Touch ID. Physical Titanium cards carry minimal information to reduce fraud risk. Furthermore, Apple Card charges no hidden fees, foreign transaction fees, or annual fees. Consequently, this combination of security, simplicity, and instant rewards encourages responsible financial management while giving users peace of mind.

Types of Apple Card

Apple offers two main card options: the virtual Apple Card and the physical Titanium card. First, the virtual card works exclusively with Apple Pay. Users can make secure, contactless payments with an iPhone, Apple Watch, or other compatible devices. This eliminates the need for a physical card for most daily transactions, increasing convenience and safety. Purchases through Apple Pay earn two percent Daily Cash, while Apple Store purchases earn three percent. Moreover, Apple credits rewards instantly, enabling users to spend them immediately without waiting.

The Titanium Apple Card complements the digital card by allowing payments at stores that do not accept Apple Pay. Unlike traditional cards, it does not display the card number, expiration date, or CVV; these details appear in the Wallet app for online or phone transactions. Titanium cardholders earn one percent Daily Cash and can build credit by reporting activity to credit bureaus. Additionally, users activate the card via NFC pairing, making it ready for in-store or online use. As a result, the Titanium card combines style, practicality, and security, providing a seamless experience for users across all purchasing scenarios.

How to Use Apple Card with Apple Pay

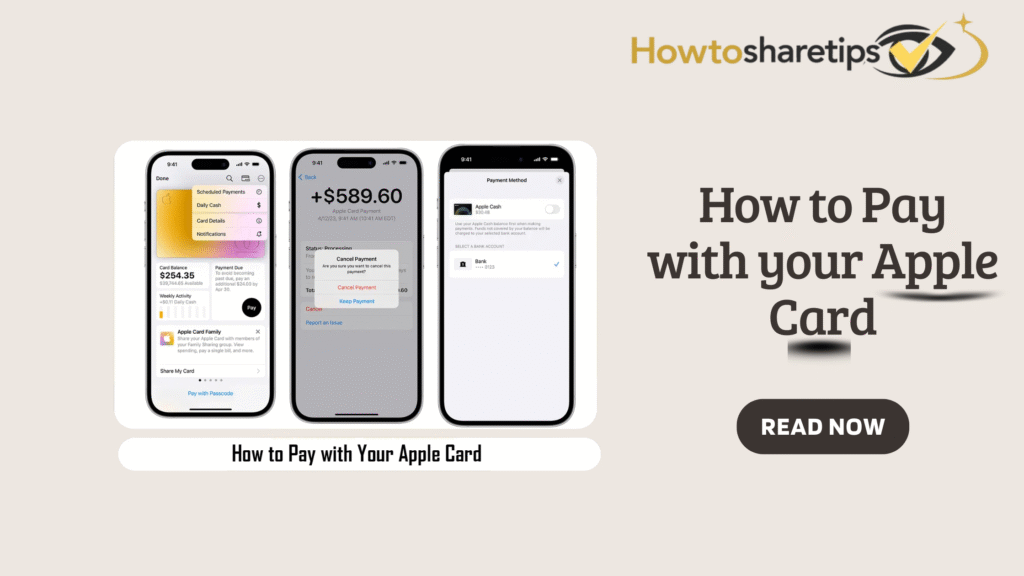

Apple Pay enables fast and secure payments. On iPhones, users authenticate with Face ID, Touch ID, or passcode, select Apple Card as the payment method, and hold the device near a contactless reader. Apple processes transactions instantly, and the device confirms completion. Similarly, on Apple Watch, double-clicking the side button brings up the default card, and users can scroll to select a different card if needed. The watch confirms payment with a gentle tap and sound. Consequently, contactless payments provide speed, convenience, and security, making them ideal for everyday purchases.

Apple Card also works for online purchases and in-app payments. At checkout, users select Apple Pay and choose Apple Card. Apple securely stores card details, preventing merchants from accessing them, which reduces fraud risk. Even if Apple Pay is unavailable, the Titanium card functions like a traditional card while retaining Apple Card’s security features. Users can generate new card numbers in the Wallet app to protect online transactions, therefore adding flexibility and peace of mind.

Managing Rewards and Payments

Apple credits Daily Cash rewards instantly. Purchases from Apple and select partners earn three percent, Apple Pay transactions earn two percent, and the Titanium card earns one percent. Rewards appear daily in the Apple Cash account and remain ready to spend or apply to the Apple Card balance. As a result, this system encourages disciplined spending while enabling users to manage finances efficiently.

Users can pay their Apple Card balance directly through the Wallet app. They can select the minimum payment, full balance, or a custom amount. The app calculates interest for partial payments and sends reminders for upcoming due dates. Consequently, users can stay organized and avoid late fees. In addition, the Wallet app allows users to track their spending trends over time, highlighting areas where adjustments may improve financial health.

Security and Privacy Features

Apple prioritizes security in every transaction. Apple Pay uses unique device numbers, and every transaction requires Face ID, Touch ID, or passcode verification. Titanium cards carry minimal identifying information, reducing the risk of theft or fraud. Additionally, users can request replacement cards or generate new digital card numbers for online purchases. Therefore, these measures protect both money and personal data, giving users confidence while using Apple Card in digital and physical formats.

Apple also provides options to lock or deactivate the card instantly in case of loss or theft. As a result, users maintain full control and security over their finances at all times. Moreover, these protections make Apple Card one of the most secure options among modern credit cards.

Comparing Apple Card to Traditional Credit Cards

Apple Card differs from traditional credit cards in several ways. First, it has no annual fees, foreign transaction fees, or hidden charges. In contrast, many standard credit cards include fees that can reduce rewards or increase costs. Moreover, the integration with Apple devices allows users to monitor spending in real time, whereas traditional cards often require third-party apps or web portals.

Additionally, the Daily Cash rewards system contrasts with standard monthly cashback rewards, providing immediate financial benefits. Apple’s transparent fee structure also reduces the risk of unexpected charges. Consequently, users can make informed financial decisions without worrying about hidden costs.

How to Maximize Apple Card Rewards

Maximizing Apple Card rewards requires strategic use. First, prioritize purchases at Apple and Apple Pay merchants to earn the highest cash back. Moreover, plan online purchases through Apple Pay to benefit from two percent Daily Cash. In addition, apply earned Daily Cash to your balance to reduce debt faster or transfer it to Apple Cash for flexible spending.

Apple also offers periodic promotions with partner merchants. Therefore, staying informed about these opportunities can further increase rewards. Finally, consistent use of Apple Card for routine expenses, like groceries or subscriptions, ensures that rewards accumulate steadily over time.

Apple Card Frequently Asked Questions (FAQs)

What is the Apple Card and how does it work?

Apple Card is a digital-first credit card created by Apple in partnership with Goldman Sachs and Mastercard. Users primarily manage it through Apple Pay on Apple devices. The Titanium card allows in-person purchases where Apple Pay is unavailable. Additionally, the Wallet app provides real-time transaction tracking, spending summaries, and Daily Cash rewards. Apple focuses on simplicity, transparency, and security, offering no fees and instant card locking if lost.

How do I set up Apple Card for payments?

Open the Wallet app on your iPhone and tap the “+” icon to apply. Once approved, the Apple Card appears immediately in the Wallet app, ready for Apple Pay purchases. The Titanium card usually arrives in a few days for locations that do not accept Apple Pay. During setup, users configure payment preferences, automatic payments, and enable Face ID or Touch ID for added security.

Can I use Apple Card internationally?

Yes. Apple Card works anywhere Mastercard is accepted. Users can pay with Apple Pay or the Titanium card for in-person purchases. Online and in-app payments work internationally. Moreover, Apple charges no foreign transaction fees, making the card cost-effective for travelers.

How do I pay my Apple Card balance?

Users pay directly through the Wallet app. Open Apple Card, tap “Pay,” and choose the payment amount—from minimum to full balance. One-time or recurring payments are available. Apple calculates interest if the full balance is not paid and sends reminders for upcoming due dates.

Conclusion

Apple Card combines convenience, security, and rewards in one integrated financial tool. Daily Cash delivers instant rewards, while the Titanium card ensures usability where Apple Pay is unavailable. In addition, integration with the Apple ecosystem allows users to track spending, manage payments, and protect sensitive information. Apple Card provides a modern, user-friendly approach to credit, emphasizing transparency, security, and responsible financial management. Therefore, for iPhone users seeking a seamless, reliable credit experience, Apple Card offers a practical and efficient solution. Ultimately, it is an excellent choice for anyone looking to combine technology with smart financial management.